richmond property tax calculator

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Property Taxes Due 2021 property tax bills were due as of November 15 2021.

Gta Cities With The Highest And Lowest Property Taxes Storeys

Ad Just Enter your Zip for Property Values By Address in Your Area.

. Formulating real estate tax rates and conducting appraisals. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Richmond County. The average effective property tax rate.

Expert Results for Free. To pay your 2019 or newer property taxes online. Free Comprehensive Details on Homes Property Near You.

Under the state Code reexaminations must occur at least once within a three-year timeframe. A 10 yearly tax hike is the maximum raise allowed on the capped properties. For all who owned property on January 1 even if the property has been sold a tax bill will still be.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Richmond County collects on average 103 of a propertys. Property Taxes Due 2021 property tax bills were due as of November 15 2021.

Richmond City collects on average 105 of a propertys assessed. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. For comparison the median home value in Richmond County is.

Along with collections property taxation involves two additional general steps. If you cannot find your assessment notice property owners can visit wwwmpacca and select the Property Owners option at the top menu bar then click on AboutMyPropertyTM or call Access. Submit Tax Payments PO.

Richmond County collects on average 062 of a propertys. While observing legal restraints mandated by statute New Richmond enacts tax rates. The median property tax in Richmond County New York is 2842 per year for a home worth the median value of 461700.

Taxing units include Richmond county. For comparison the median home value in Richmond County is. Ad Find out directory of all your local government offices online for free.

City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Mailing Contact Information. Search for all public records here including property tax court other vital records.

It is one of the most populous cities in Virginia. Reserved for the county however are appraising property issuing billings taking in collections carrying. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

Box 4277 Houston TX 77210-4277. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. These documents are provided in Adobe Acrobat PDF format for printing.

The median property tax in Richmond County North Carolina is 732 per year for a home worth the median value of 71300. The City Assessor determines the FMV of over 70000 real property parcels each year. For all who owned property on January 1 even if the property has been sold a tax bill will still be.

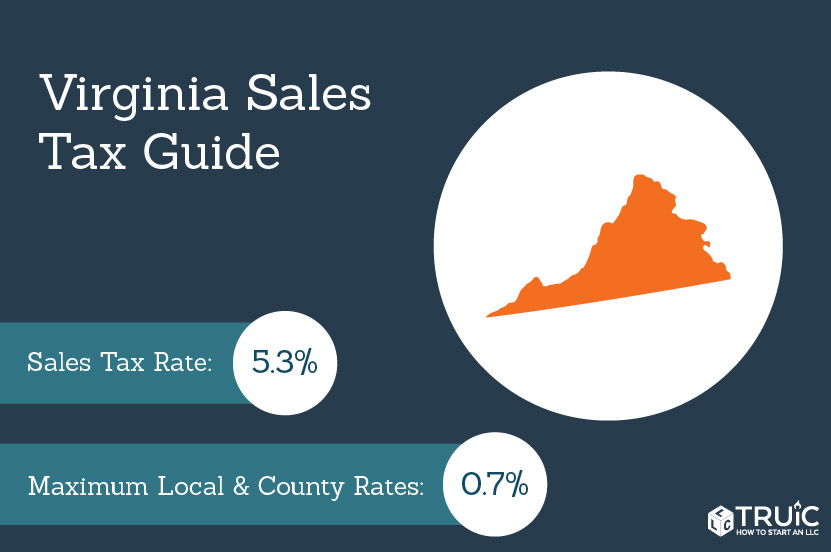

General Correspondence 1317 Eugene Heimann Circle Richmond TX 77469-3623. The citys average effective property tax rate is 111 among the 20 highest in Virginia. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered.

Fort Bend County Property Values Up 35 Percent Since 2012 Community Impact

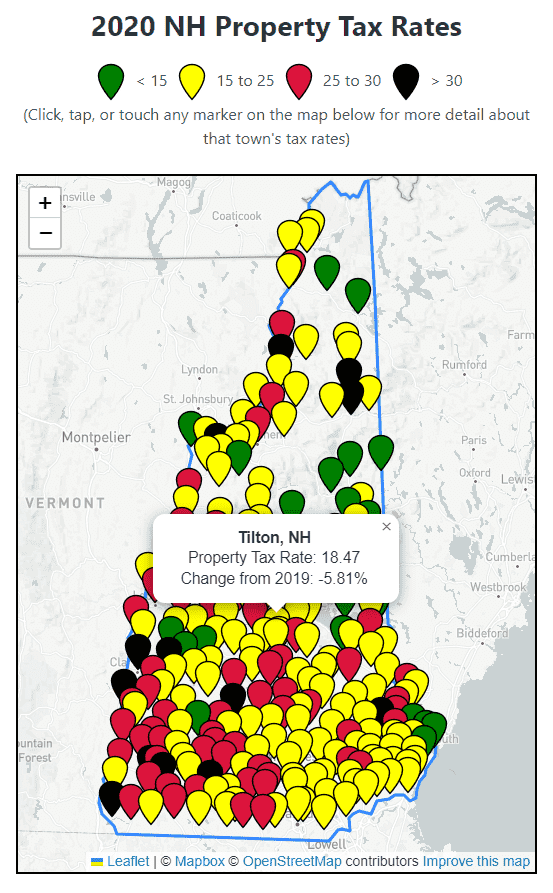

2020 New Hampshire Property Tax Rates Nh Town Property Taxes

:format(webp)/https://www.thestar.com/content/dam/localcommunities/richmond_hill_liberal/news/2021/12/12/richmond-hill-council-delivers-second-consecutive-property-tax-freeze/10536073_Budget-2022-Budget-Graphic-5x2-P490-HighRez.jpg)

Richmond Hill Council Delivers Second Consecutive Property Tax Freeze The Star

Richmond Va Cost Of Living 2022 Is Richmond Va Affordable Data Tips Info

Toronto Property Taxes Explained Canadian Real Estate Wealth

Restricted Archives Gaamagazine Com

Houston Property Tax Rates By Cutmytaxes Issuu

Where Your Property Tax Dollars Go Contra Costa County Ca Official Website

What You Should Know About Contra Costa County Transfer Tax

Virginia Property Tax Calculator Smartasset

Vermont Property Tax Rates Nancy Jenkins Real Estate

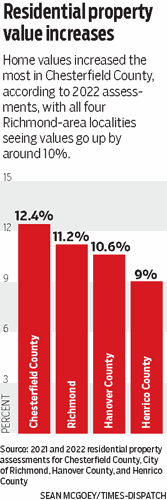

Where Richmond Property Values Went Up Most Axios Richmond

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Are Texas Property Taxes Calculated And How Much Of The Money Goes To Schools Guide For The 2019 Legislative Session The Texas Tribune

Indiana Sales Tax Rate Rates Calculator Avalara

Can You Explain The Proposed Property Tax Increase For Knoxville Tennessee Mansion Global

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments